Redlands Bankruptcy Attorney

Most bankruptcies are filed by individuals and business owners because of unforeseen events such as a layoff, a catastrophic illness or accident or a downturn in the economy. Redlands business owners and consumers who are drowning in debt can call a Redlands bankruptcy attorney at (888) 754-9877

Bankruptcy can erase certain debt and allow debtors to return secured property without any further obligations. Debtors can also repay creditors over time that allows them to retain their assets or it gives a business an opportunity to return to solvency while reorganizing. Consumers have to meet certain eligibility criteria that a Redlands bankruptcy attorney can confirm.

Consult with a Redlands bankruptcy attorney if you considering bankruptcy. You can rely on a Redlands bankruptcy attorney to give you honest and sound advice.

Chapter 7 Bankruptcy

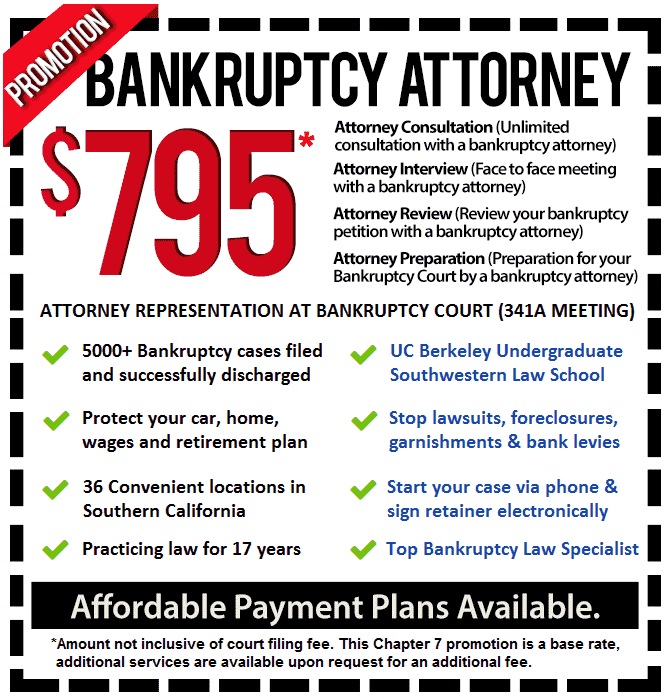

Chapter 7 is a straight bankruptcy where consumers can discharge debt like medical bills, department store charges, credit cards, payday loans, unpaid rent and utilities and personal loans among others. Business debt can be discharged as well. A Chapter 7 Bankruptcy Lawyer determines a consumer’s eligible status to file. The Chapter 7 Bankruptcy Lawyer also reviews a consumer’s assets to see if they are non-exempt.

Businesses can dissolve their operations and sell off assets to pay creditors to an extent without further obligation.

Redland consumers do have certain obligations that a Chapter 7 Bankruptcy Lawyer will ensure you follow. Your only appearance is before a trustee with your Chapter 7 Bankruptcy Lawyer accompanying you. You should have no issues if you have retained a Redlands bankruptcy lawyer.

At the end of 4 months, certain of your debts will be discharged.

Chapter 13 Bankruptcy

Some Redlands consumers will exceed the income levels and may be advised by a Chapter 13 Bankruptcy Attorney to file Chapter 13. This is a repayment proceeding where primarily secured creditors are paid back over 3 or 5 years pursuant to a plan formulated by a Chapter 13 Bankruptcy Attorney.

With the assistance of a Chapter 13 Bankruptcy Attorney, homeowners can avoid foreclosure and Redlands residents may elude auto repossession. Arrearages for these loans as well as student loans, alimony or child support can be included in the plan.

Unsecured creditors are only paid if they would have been under a Chapter 7. Otherwise, those debts will be discharged. Redlands sole proprietors may also file and include business debt if it was personally guaranteed. For more information, contact a Redlands bankruptcy lawyer.

Chapter 11 Bankruptcy

If your business, corporation or partnership is struggling to make ends meet, a business reorganization may be advised by a Chapter 11 Bankruptcy Attorney. In some cases, creditors can force a company into involuntary bankruptcy.

Once filed, a Chapter 11 Bankruptcy Attorney prepares a disclosure statement for the creditors’ benefit and a reorganization plan for certain creditors and equity holders to confirm or reject by vote. If confirmed, the company may continue its usual operations without trustee oversight unless it is deemed a small business that requires supervision.

The company’s plans for restructuring usually includes downsizing or selling off assets so as to re-direct funds toward profitable areas or other major business decisions that may include breaking existing contracts, leases and other agreements and re-negotiating them. Any major business decision must court approved before implementation.

A Redlands bankruptcy lawyer will file progress reports and handle creditor issues.

Call a Redlands bankruptcy lawyer at (888) 754-9877 regarding your debt issues to see if bankruptcy can be a practical solution for you or your business.